Women’s health is one pocket of U.S. healthcare, gaining more attention, traction, and industry excitement. In the realm of digital health, this is often referred to as “FemTech,” which McKinsey describes as a “wide range of solutions to improve healthcare for women across a number of female-specific conditions, including maternal health, menstrual health, pelvic and sexual health, fertility, menopause, and contraception, as well as a number of general health conditions that affect women disproportionately or differently.” In the past four or five years, there’s been a flurry of new investment activity, consumer interest, and market demand for these digital solutions geared toward solving long-standing women’s health challenges that the industry has ignored at large. And while countless hyperbolic FemTech headlines compete to capture our attention, what does the current state of FemTech tell us about the direction of women’s health?

What’s Behind the Current Wave of FemTech Interest and Funding?

Several dynamics at play have catalyzed the most recent flood of investment activity and market growth for FemTech and women’s health solutions in general, starting with the fact that women’s health has always been an area of healthcare that is underfunded, under researched, and underdeveloped when it comes to new products and services. While this has long been a potential area of meaningful growth and expansion, recent legal and cultural events have put an even bigger spotlight on women’s health. The #MeToo movement significantly changed the public discourse around women’s issues and the conversation has organically evolved since. In June 2022, the U.S. Supreme Court overturned Roe v. Wade, removing fundamental rights and bodily autonomy for pregnant women and fueling a surge in FemTech startups aimed to help alleviate some of these immediate challenges.

In 2013, more than 50 FemTech startups received from U.S. venture capital and private equity funds. Since then, U.S. VC and PE investment into FemTech has exploded, with nearly 6X as many startups getting funding deals each year from 2019 -2021, and total FemTech funding exceeding $1 billion for the first time in 2021. These investment trends indicate that FemTech’s U.S. growth is real.

Takeaways from 50 Top Privately Held, Investor Backed FemTech Startups

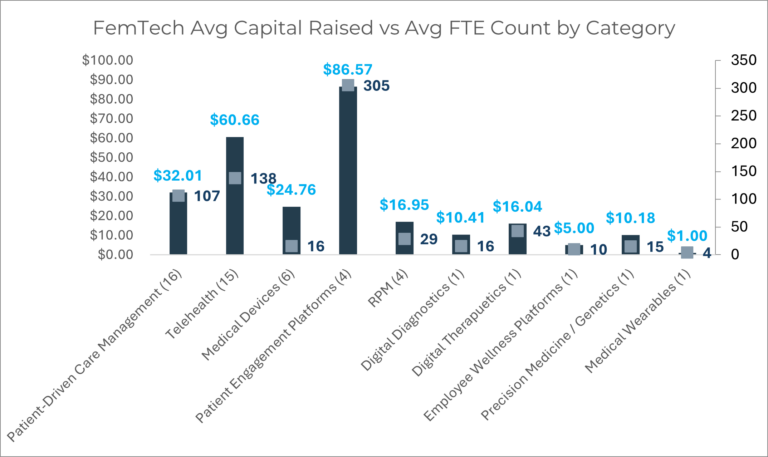

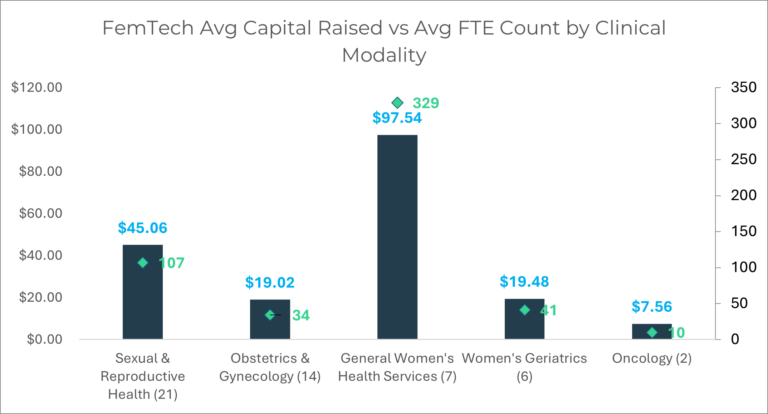

For this analysis, we collated information on 50 VC- or PE-backed, privately held, revenue-generating U.S. FemTech companies. While not a perfect or fully exhaustive list, these 50 FemTech startups can tell us a lot about the specific categories or niches of women’s health that are generating the most interest and likely have the most U.S. healthcare staying power, as outlined in tables 1 and 2, and graphics 3 and 4 below.

| Digital Health Category | Vendor Count | Sum Total Raised | Total FTEs |

|---|---|---|---|

| Patient-Driven Care Management | 16 | $512.17 | 1,705 |

| Telehealth | 15 | $909.97 | 2,068 |

| Medical Devices | 6 | $148.54 | 96 |

| Patient Engagement Platforms | 4 | $346.26 | 1,221 |

| Remote Patient Monitoring | 4 | $67.80 | 115 |

| Digital Diagnostics | 1 | $10.41 | 16 |

| Digital Therapeutics (DTx) | 1 | $16.04 | 43 |

| Employee Wellness Platforms | 1 | $5.00 | 10 |

| Genetics | 1 | $10.18 | 15 |

| Wearables | 1 | $1.00 | 4 |

| Grand Total | 50 | $2,027.37 | 5,293 |

Table 1: 50 FemTech Startups: Vendor Count, Sum Total Funding Raised and Total FTE count by digital health category. The sum total figures raised within the tables of the blog post are in increments of $Millions USD.

| Clinical Modality | Vendor Count | Sum Total Raised | Total FTEs |

|---|---|---|---|

| Sexual & Reproductive Health (SRH) | 21 | $946.35 | 2,245 |

| Obstetrics& Gynecology | 14 | $266.27 | 478 |

| Women's Health Services | 7 | $682.75 | 478 |

| Women's Geriatrics | 6 | $116.89 | 247 |

| Oncology | 2 | $15.11 | 20 |

| Grand Total | 50 | $2,027.37 | 5,293 |

Table 2: 50 FemTech Startups: Vendor Count, Sum Total Funding Raised and Total FTE count by clinical modality. The sum total figures raised within the tables of the blog post are in increments of $Millions USD.

Several prevailing themes of note emerge upon analyzing these investment and growth dynamics across these 50 FemTech startups (both by digital health category and by clinical modality), including but not limited to:

- The majority of the more than $2 billion in total investment capital across these 50 FemTech startups went to telehealth solutions (45%), patient-driven care management applications (25%), and patient engagement platforms (17%).

- There is a huge demand for patient-driven care management solutions within FemTech, as reflected in the share of FemTech startups that fall within that category and the sectors’ overall figures for raised capital.

- Nearly $1 billion (or around half of the total capital raised) has been invested to support a burgeoning market of at least 21 privately held FemTech solutions for sexual and reproductive health (SRH). While SCOTUS’ 2022 Roe v. Wade reversal likely played a role in this, this aligns with historical industry analysis showing that roughly 50% of FemTech fundraising from 2012-2021 went to SRH.

- A handful (7) of very large FemTech Startups aimed at addressing all or most of women’s health clinical modalities have raised, on average, more than $97 million each—which reflects the outsized capital demands for building a comprehensive women’s health solution.

There is much more happening in the exciting landscape of FemTech than we can realistically cover in this (limited) analysis. Yet, we could unpack the implications from this data for quite some time. At Panda Health, we’re committed to giving our health system community a degree of market transparency and unbiased comparative intelligence on the landscape of existing digital health solutions that support them. Click here to learn more about joining the Panda Health community and the latest in FemTech.